WILMINGTON — A Wilmington optometrist’s office has again been shut down by the state for failing to pay sales taxes, according to the Ohio Department of Taxation.

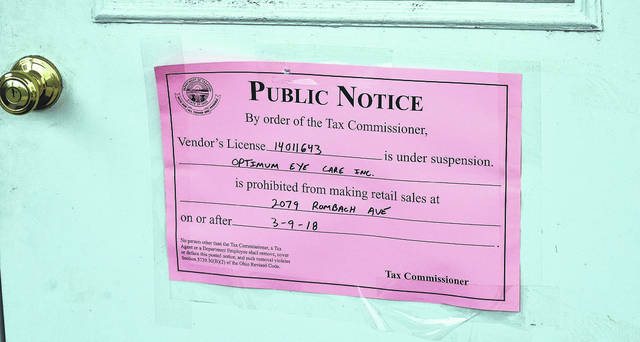

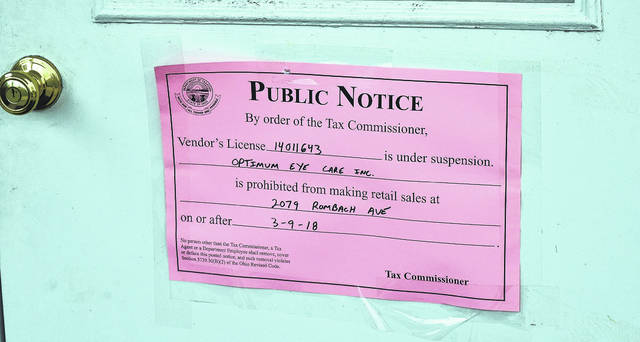

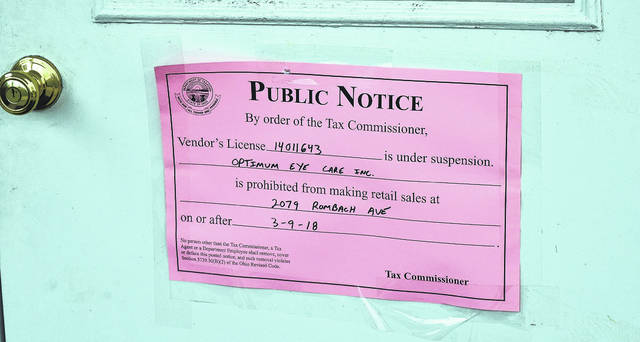

Optimum Eyecare at 2079 Rombach Ave. was shut down, or “posted”, by the Ohio Department of Taxation last Friday, according to ODT Communications Manager Gary Gudmundson.

“Basically, this prohibits a business from making retail sales until it pays in full the amount of sales tax it owes. It’s generally the result of a business with a history of non-compliance with sales tax law,” Gudmundson said.

He said that if a business fails to file/pay two months of taxes or has failed to pay three times within a 12-month period, “We have the authority to shut a business down.”

Gudmundson said that shutting down a business is “not something we like to do.” He explained that state sales tax is a “trust tax” in which the state trusts a business to collect tax for the state — and businesses even get some compensation for doing that.

But when they fail to pay, “Essentially, they’re keeping state money,” said Gudmundson.

The Ohio Department of Taxation posts, on average, 50-100 businesses statewide per month, he said.

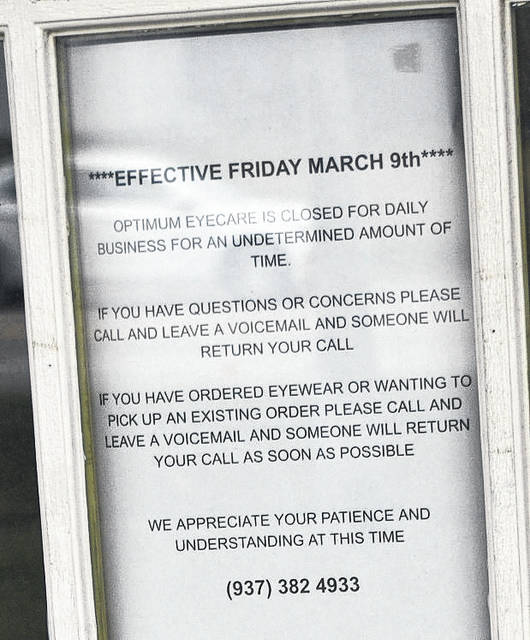

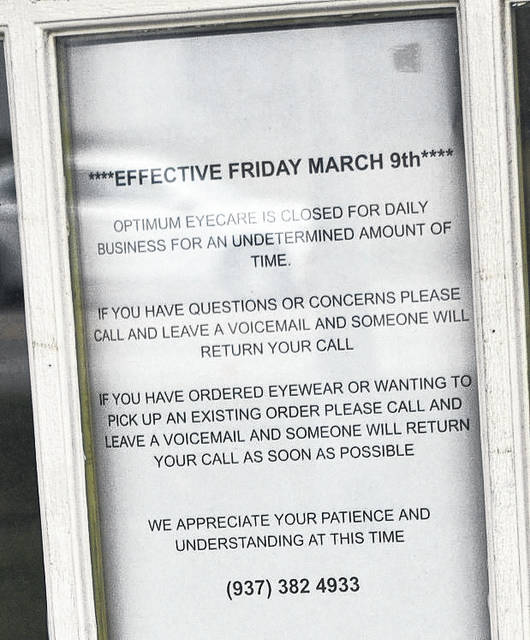

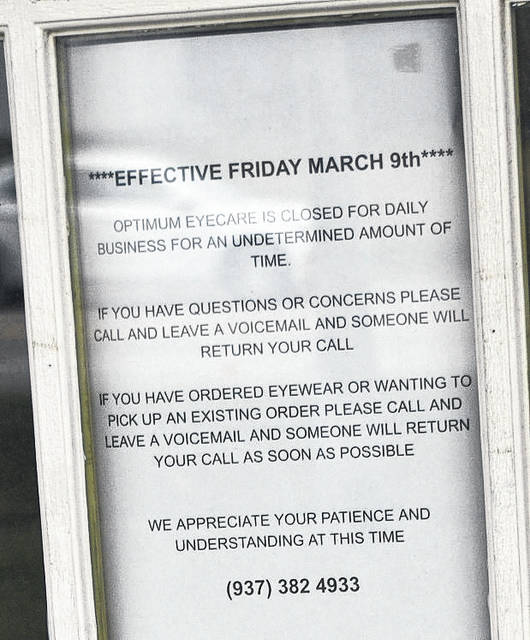

“Typically the ones who get posted pay up the same day” because if they don’t, they can’t operate the business, Gudmundson said. He added that the ODT had not heard from Optimum Eyecare regarding the closure as of late Tuesday morning.

On the Ohio Secretary of State website, the “Agent/Registrant Information” for Optimum Eyecare lists the name of David T. Brown.

A phone call by the News Journal to the business on Tuesday morning seeking comment went to voicemail.

A portion of a post on the business’ Facebook page Monday from a person saying she was a client stated: “I decided to wait until Monday (today) to pick (glasses) up since the kids didn’t have school today only to find out that they have shut their doors. This is the second time since being their patient (which hasn’t been long) that they have lost their license to sell and now they are completely closed.”

A Google Review posted Monday stated, “My son went in for a scheduled appointment today to find out they are closed due to licensing issue. Not a phone call or message notifying us. Looks like it’s time to find another optometrist.”

According to the Ohio Department of Taxation website: “Your vendor’s license may be suspended if you fail to file sales tax returns when due or you fail to pay the tax due thereon. If your vendor’s license is suspended, no retail sales may be made until the license is reinstated. To have a suspended license reinstated, you would be required to file complete and correct returns for all periods and pay the full amount of tax, penalties, and other charges due on those returns. You may also be required to furnish security in an amount equal to your average tax liability for one year.”