WILMINGTON — Police want to know if you haven’t received goods or services that you paid for from optometrist David T. Brown and Optimum Eyecare Inc. at 2079 Rombach Ave.

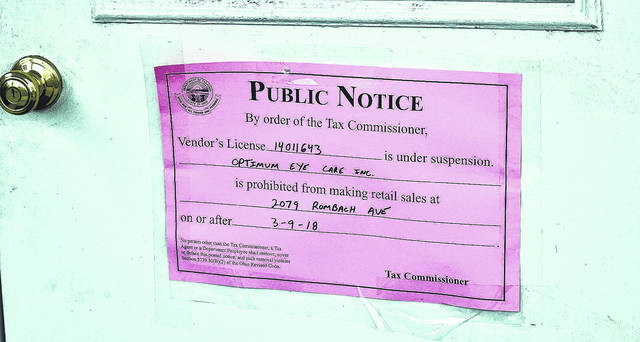

The News Journal reported last month that Optimum Eyecare was shut down by the state for failing to pay sales taxes, according to the Ohio Department of Taxation (ODT).

Wilmington police have received calls regarding citizens not receiving items from the business, stated Police Chief Duane Weyand in a press release.

He said the department is currently “looking into the matter to determine if this is a criminal matter or civil. We encourage any person who has paid for services and failed to receive their product to contact Officer Whitney Johnson, who is the officer handling this matter.”

The News Journal was also contacted this week by a resident who claimed to have paid several hundred dollars for glasses that were never received, who added that, when they tried to call the business, the voice mailbox was full.

The News Journal called Optimum Eyecare Friday and also received a message that Dr. Brown’s voice mailbox was full.

Facing eviction

Optimum Eyecare also faces eviction from the building the business occupies in the wake of a lawsuit filed April 2 in Clinton County Municipal Court by retired optometrist W. Glenn MacDonald and his wife Lorie E. MacDonald. The MacDonalds own the building that Optimum Eyecare occupies.

Attorney Joshua Schierloh of Dayton represents the MacDonalds in the lawsuit. He told the News Journal Friday that his firm typically does not comment on pending litigation.

No attorney is listed for the defendant on the municipal court website.

A hearing on the suit is scheduled for 2:45 p.m. April 17.

Ohio Department of Taxation Communications Manager Gary Gudmundson told the News Journal last month that “posting” — the ordering of a business to be closed — “prohibits a business from making retail sales until it pays in full the amount of sales tax it owes. It’s generally the result of a business with a history of non-compliance with sales tax law.”

He said that if a business fails to file/pay two months of taxes or has failed to pay three times within a 12-month period, “We have the authority to shut a business down.”

Gudmundson said that shutting down a business is “not something we like to do.” He explained that state sales tax is a “trust tax” in which the state trusts a business to collect tax for the state — and businesses even get some compensation for doing that.

But when they fail to pay, “Essentially, they’re keeping state money,” said Gudmundson.

“Typically the ones who get posted pay up the same day” because if they don’t, they can’t operate the business, Gudmundson said.