CINCINNATI – The cheapest gas price averages can be found in the Great Lakes and Central States region, as gas prices continue to push cheaper across the country.

Seven states from the region land on the top 10 list for cheapest averages in the country: Ohio ($1.38), Wisconsin ($1.19), Michigan ($1.40), Kentucky ($1.43), Indiana ($1.44), Missouri ($1.46) and Iowa ($1.47). On the week, state gas price averages decreased as much as a nickel in the region.

Regional gasoline stocks decreased in EIA’s latest report while regional refinery utilization held steady. Stocks drew by 1.7 million bbl to total 58.4 million bbl. Refinery rates were stable at 65%, though down significantly compared to rates this time last year of 92%.

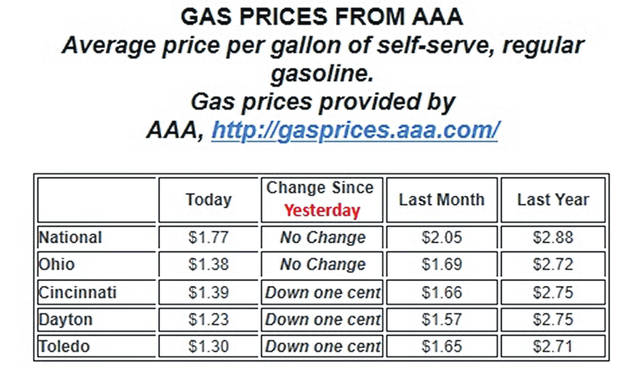

Only one dozen states carry an average of $2/gallon or more. Today’s national average is $1.77, which is four cents less than last week, 28 cents cheaper than last month and $1.11 less than a year ago.

Crude oil prices were extremely volatile last week, pushing negative for the first time ever, but they did make significant gains to end the week in the positive. The Energy Information Administration (EIA) reported demand at 5.3 million b/d, a slight increase, but still an extremely low rate compared to last April’s 9.45 million b/d average.

Low demand pushed gasoline stocks to increase for yet another week, this time by 1 million bbl to put total U.S. stock levels at 263 million bbl.

“AAA forecasts that the national average will continue to decrease into next month, possibly dropping as low as $1.65,” said Jenifer Moore, AAA spokesperson. “We haven’t seen gas prices that cheap since January 2009.”

Some states could see minimal fluctuation at the pump in coming weeks if demand jumps as business are given the green light to re-open. However, this will not have a large impact for the majority of the nation’s motorists.

Oil market dynamics

At the end of Friday’s formal trading session, WTI increased by 44 cents to settle at $16.94 per barrel. Crude prices have recovered after turning negative last week for the first time since trading in 1983.

Last week’s decline in prices has been attributed to many factors, including the inability of market traders who owned oil futures to find other market participants to sell their futures contracts to and limited available crude storage options.

Crude prices started to push more expensive by the end of last week in response to reports of the Organization of the Petroleum Exporting Countries reducing crude output before the May 1 start date of its 9.7 million b/d production reduction agreement for May and June 2020.

Crude prices will likely remain volatile this week, as the market continues to assess how much crude demand will continue to fall during the ongoing pandemic.

For more information, visit www.AAA.com.